Managing personal finance and investing wisely are essential skills for achieving financial independence and building long-term wealth. In this blog, we will walk you through the key principles of personal finance and investment strategies to help you make informed decisions and grow your wealth.

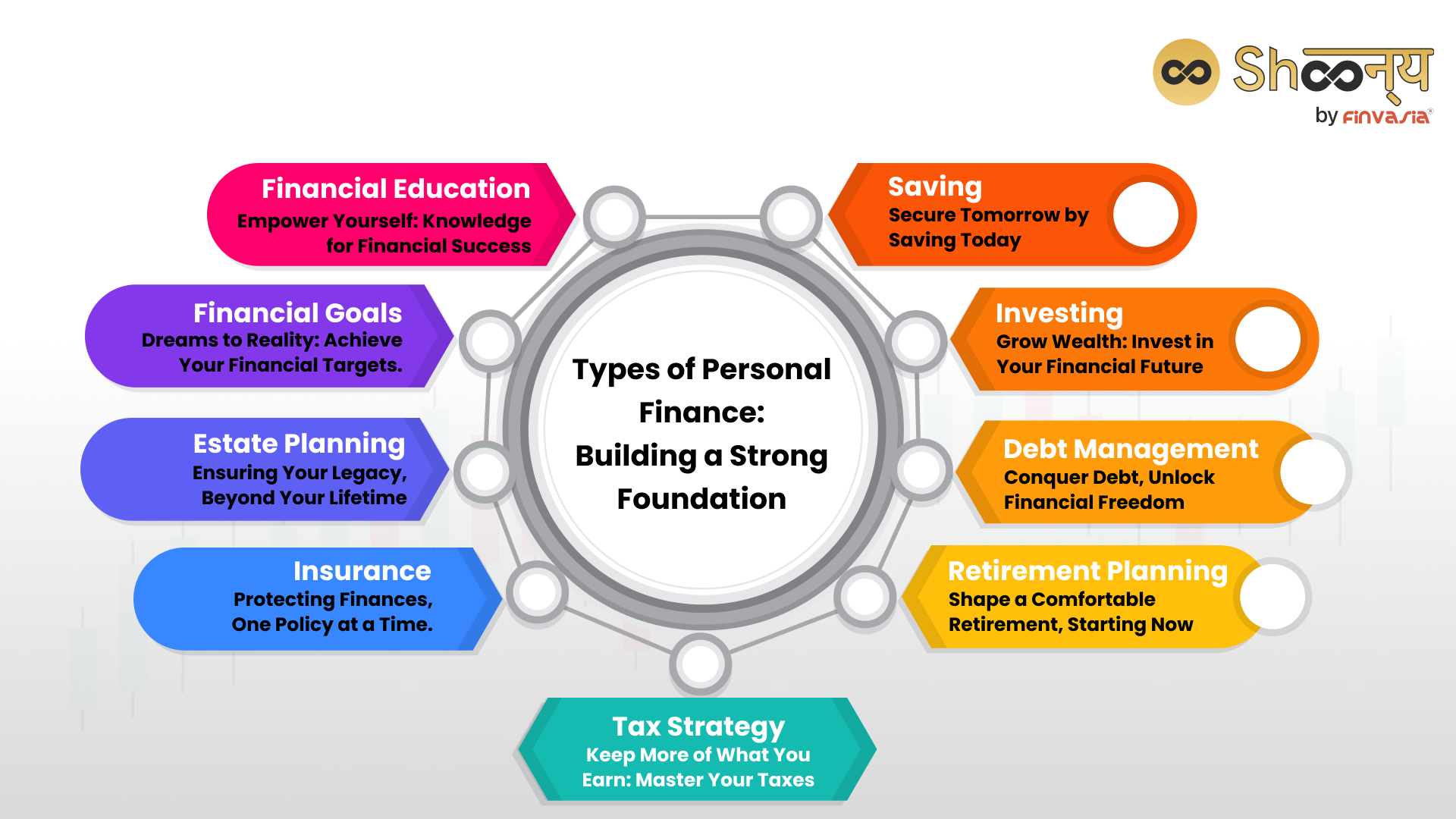

Understanding Personal Finance: The Foundation of Financial Health

Personal finance is about managing your money to meet your goals and live comfortably. Here are some essential steps to take control of your finances:

Budgeting

Budgeting is the cornerstone of good financial management. Start by tracking your income and expenses to understand where your money goes. There are many apps like Mint or YNAB (You Need a Budget) that can simplify this process. Allocate your income to essential expenses (rent, utilities, groceries), savings, and discretionary spending (entertainment, dining out). A general rule is to follow the 50/30/20 rule:

- 50% of your income for needs

- 30% for wants

- 20% for savings and debt repayment. Emergency Fund

An emergency fund is a financial safety net for unexpected events like medical emergencies, car repairs, or job loss. Aim to save at least 3-6 months of living expenses in an easily accessible account, such as a high-yield savings account. Debt Management

Managing debt is crucial to your financial health. Prioritize paying off high-interest debt, such as credit cards, as quickly as possible. Consider using methods like the Debt Avalanche (paying off the highest interest rate first) or Debt Snowball (paying off the smallest balance first to build momentum).

Introduction to Investment: Growing Your Wealth

Investing is the most effective way to grow your wealth over time. Unlike saving, which simply preserves your money, investing allows your money to work for you and generate returns. Here are some basic investment concepts:

Stock Market Investing

Investing in the stock market allows you to buy shares of companies and earn profits as they grow. Over time, the stock market has historically provided higher returns than most other types of investments. For beginners, it’s wise to start with index funds or ETFs (Exchange-Traded Funds) that track the market and reduce risk by diversifying your investments.

Bonds

Bonds are essentially loans you make to a company or government in exchange for interest payments. They are considered safer than stocks but typically provide lower returns. Bonds can add balance to your portfolio and provide a steady income stream.

Real Estate

Real estate is another popular investment vehicle that can provide both income and capital appreciation. Whether through direct ownership, rental properties, or real estate investment trusts (REITs), real estate can diversify your portfolio and offer potential tax advantages.

Cryptocurrency

Cryptocurrencies, such as Bitcoin and Ethereum, have gained significant attention in recent years. They are highly speculative and volatile but can offer massive returns if invested wisely. It’s crucial to approach crypto with caution, only investing money you can afford to lose.

Risk Management and Diversification

Risk Tolerance

Your risk tolerance is how comfortable you are with losing money in the short term for the chance of higher returns in the long term. If you are young and have time on your side, you might prefer a higher-risk portfolio (stocks, crypto). If you are closer to retirement, a more conservative approach (bonds, real estate) may be appropriate.

Diversification

Diversification is the practice of spreading your investments across various asset classes (stocks, bonds, real estate, etc.) to reduce risk. By not putting all your eggs in one basket, you can protect your portfolio from major losses if one sector performs poorly.

No responses yet